Organic Reusable Washable Breastfeeding Nursing Pads Leakproof Waterproof Eco

Rated 3 out of 5

2 Reusable Washable Hemp Organic Cotton Nursing Breast Pads Fleece Breastfeeding

Rated 3 out of 5

6 Washable Breast Nursing Pads Flannel Reusable Comfy! 100% Cotton Breastfeeding

Rated 3 out of 5

12pcs Organic Washable Breast Soft Pads Reusable Nursing Pads for Breastfeeding

Rated 4 out of 5

Organic Hemp Fleece Nursing Breastfeeding Pads Night Heavy Leak Extra Protection

Rated 3 out of 5

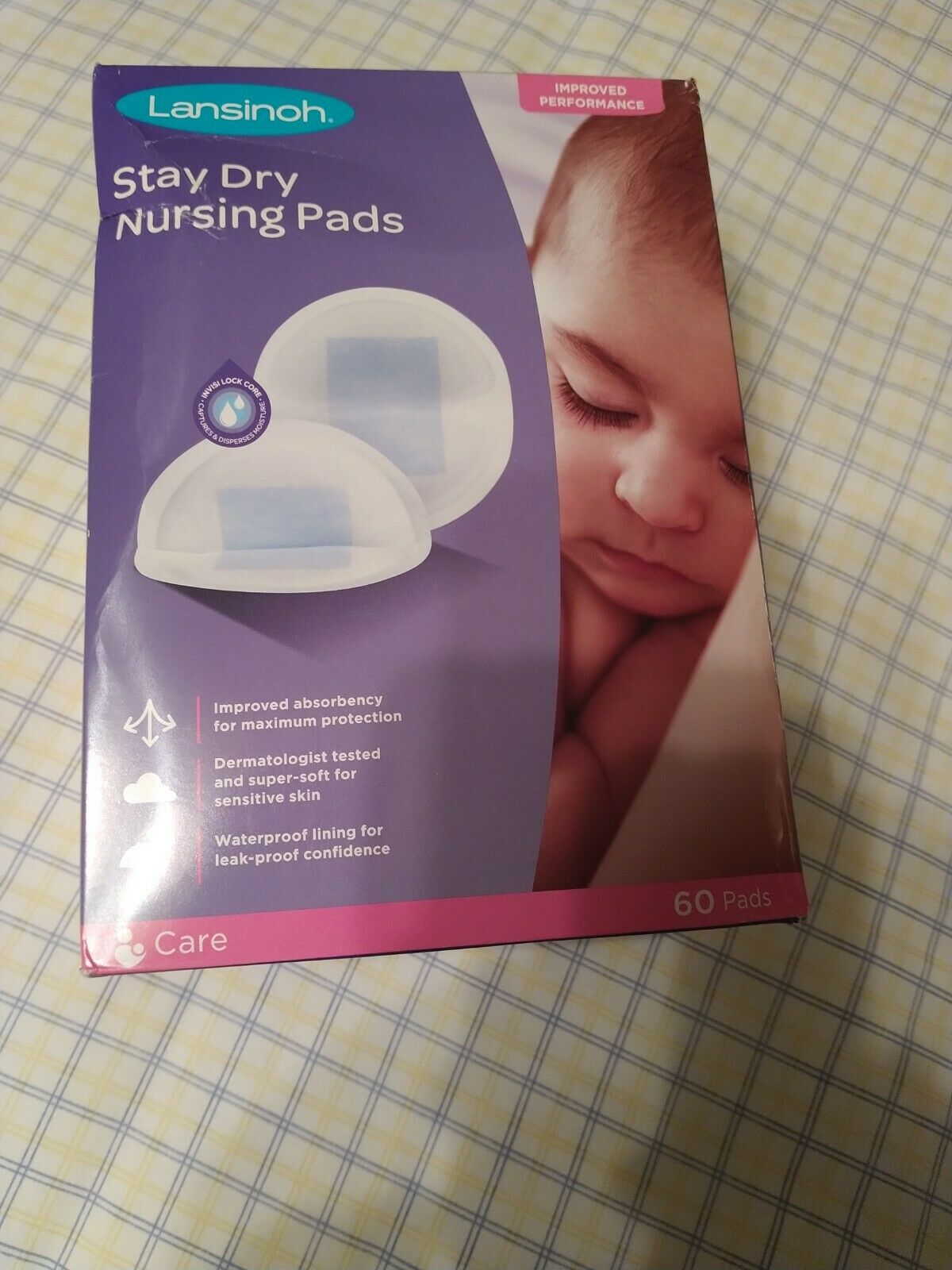

NUK Ultra Thin Disposable Nursing Pads New 66 Count Breastfeeding Supply Feeding

Rated 3 out of 5

Boob Ease Soothing Therapy Pillows Nursing Cooling Warming Relief W Bonus Pads

Rated 5 out of 5

LanaCare 100% MERINO wool breast pads nursing breastfeeding reusable washable

Rated 3 out of 5

Bamboo Reusable Breast WATERPROOF Pad Nursing Maternity 10pc+1pc Wash Bag FREE

Rated 5 out of 5

6x Reusable Cotton Breast Pads Absorbent Breastfeeding Nursing Pad Washable Pads

Rated 3 out of 5

15pcs Anti-galactorrhea Breast Pad Nursing Pad with Cotton Bags and Washing Bag

Rated 4 out of 5

Medical NON-CONTACT Body Forehead IR Infrared Laser Digital Thermometer Accurate

Rated 3 out of 5

CE FDA Medical Grade NON-CONTACT Infrared Forehead Thermometer LCD Laser IR USA

Rated 4 out of 5

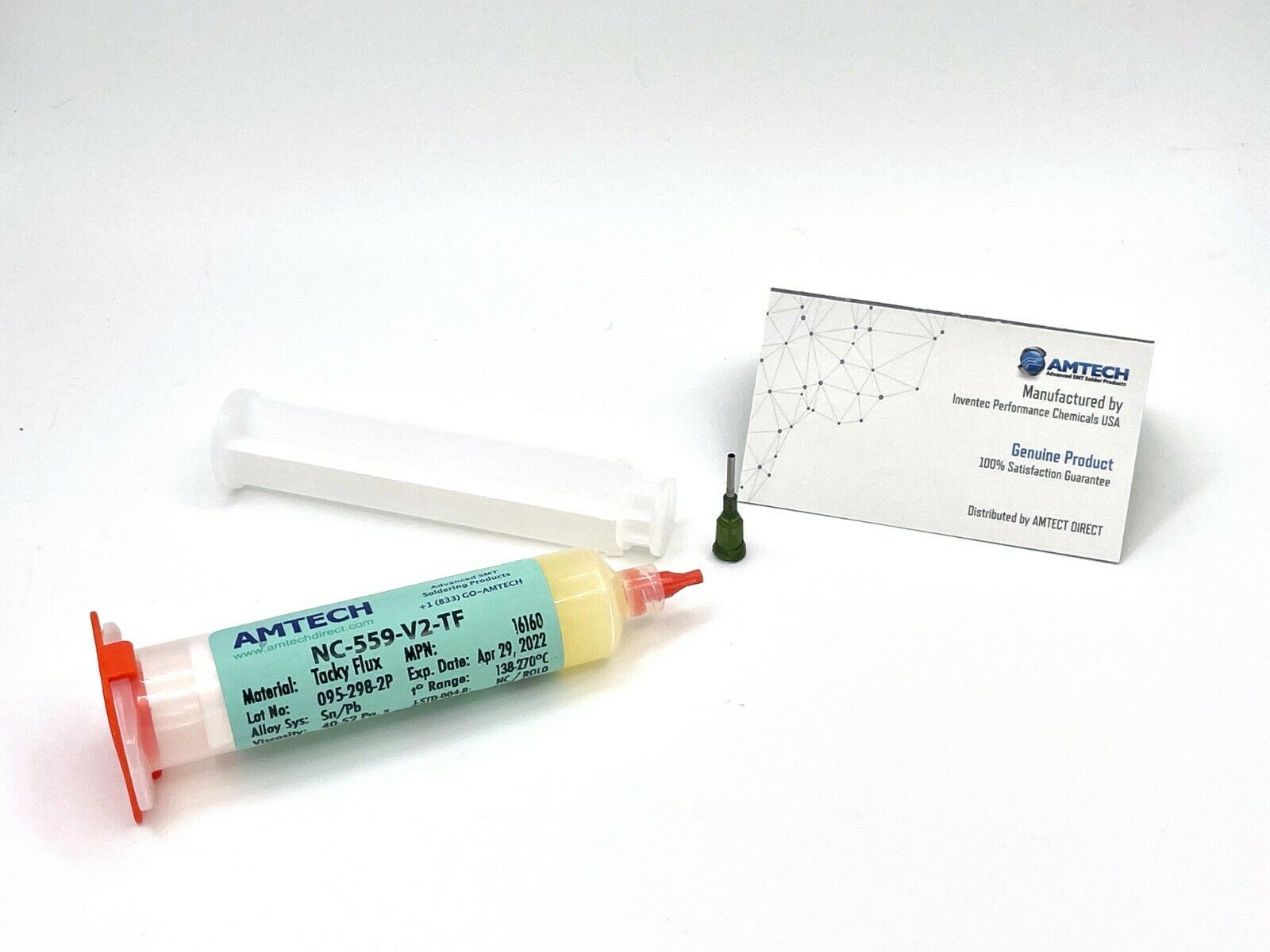

30ml Kester (1oz.) 186-18 Liq. Soldering Rosin Flux Needle Tip Bottle No Clean

Rated 5 out of 5

Helect Infrared Thermometer Non-contact Digital Laser Infrared Temperature Gun

Rated 5 out of 5

50g Rosin Soldering Flux Paste Solder Welding Grease Cream for Phone PCB Healthy

Rated 3 out of 5

NEW ! 30 ml . NEEDLE TIP BOTTLE KESTER 186 Rosin Soldering Liquid Flux NO CLEAN

Rated 3 out of 5

Rosin Soldering Flux Paste Grease 30G 30 Gram USA Seller Free Shipping Solder

Rated 3 out of 5

Kester 951 Soldering Flux Pen Low Solids No Clean 10ml for PCB & Solar Cells US

Rated 4 out of 5

Fast Wall Mount Digital Infrared Thermometer Automatic Non Contact Forehead US

Rated 5 out of 5

Solder Flux Paste Soldering Tin Cream Welding Fluxes For PCB/BGA SMD Phone Tool

Rated 4 out of 5

Beseler Cadet 3502 Black 50mm Scale Adjustable Enlarger Photography w/ Baseboard

Rated 3 out of 5

Ilford 400-HL/M-2 Multi-grade 400 6x7cm 4X5 Enlarging Head Light Mixing Box (A25

Rated 3 out of 5

DURST L-1200 4"X5" latest fine remotefocus model complete enlarger no head ITALY

Rated 3 out of 5

Enlarger Alignment Tool Omega D5 Beseler 4×5 Durst 5×7 Saunders Precision Level

Rated 4 out of 5

Lot SIMMON OMEGA Film Photo Enlarger Acc Darkroom Graflex Wollensak Hermagis

Rated 4 out of 5

Vintage Simmon Omega D2 Enlarger & A Ton Of Photography Darkroom Accessories!

Rated 3 out of 5

DURST TAUNOBOX 450 LIGHT MIXING BOX WITH GLASS heat filter. Fits CLS450 Head

Rated 5 out of 5

NEAR MINT Magna Sight Photo Darkroom Enlarging Magnifying Grain Focuser w Box

Rated 3 out of 5

Opemus lla Meopta Photo Negative Enlarger 1960's Type 74214 Czechoslovakia 2a

Rated 3 out of 5